As a society, we’re at an inflection point.

Technology is changing the ways that we interact and work with each other. Traditional industries are being replaced by new, tech-enabled alternatives. And the torch is being passed from one generation to the next.

According to data from the U.S. Census Bureau, Millennials are about to overtake Baby Boomers as the largest living generation in the U.S., with roughly 71 million people aged 20 to 35. Not “someday.” Not years from now.

This year. As in 2019.

(The slightly smaller Generation X is expected to be larger than the remaining Boomers by 2028.)

It’s impossible to overstate the implications of this. An economy and society that grew up based on the needs and wants of Baby Boomers – suburban homes, large cars, work in distant offices – is now readjusting to fit Millennials. Trends like remote working arrangements, live / work planning, and car sharing have come up in recent years not because they’re obvious choices, but because they fit with the needs of the Millennial marketplace.

It’s a Millennial world now; the rest of us are just living in it.

This is having profound implications for real estate in particular, because Millennials have been slow to strike out on their own and are buying homes at lower rates than many previous generations. According to the Urban Institute, Millennials’ homeownership rate is a full eight percentage points lower than both Gen Xers and Baby Boomers when they were the same age. To put that in perspective, if the rate had remained steady across the generations, more than 3.4 million Millennials would be living in their own homes right now.

It doesn’t take a lot of digging to uncover the reason why.

According to ApartmentList’s 2018 Millennial Homeownership Report, 72 percent of Millennial renters cite affordability as the reason that they are holding off. They’re weighed down by student debt, can’t save up for a down payment, and are unsure about their long-term financial stability.

Suggested Reading:

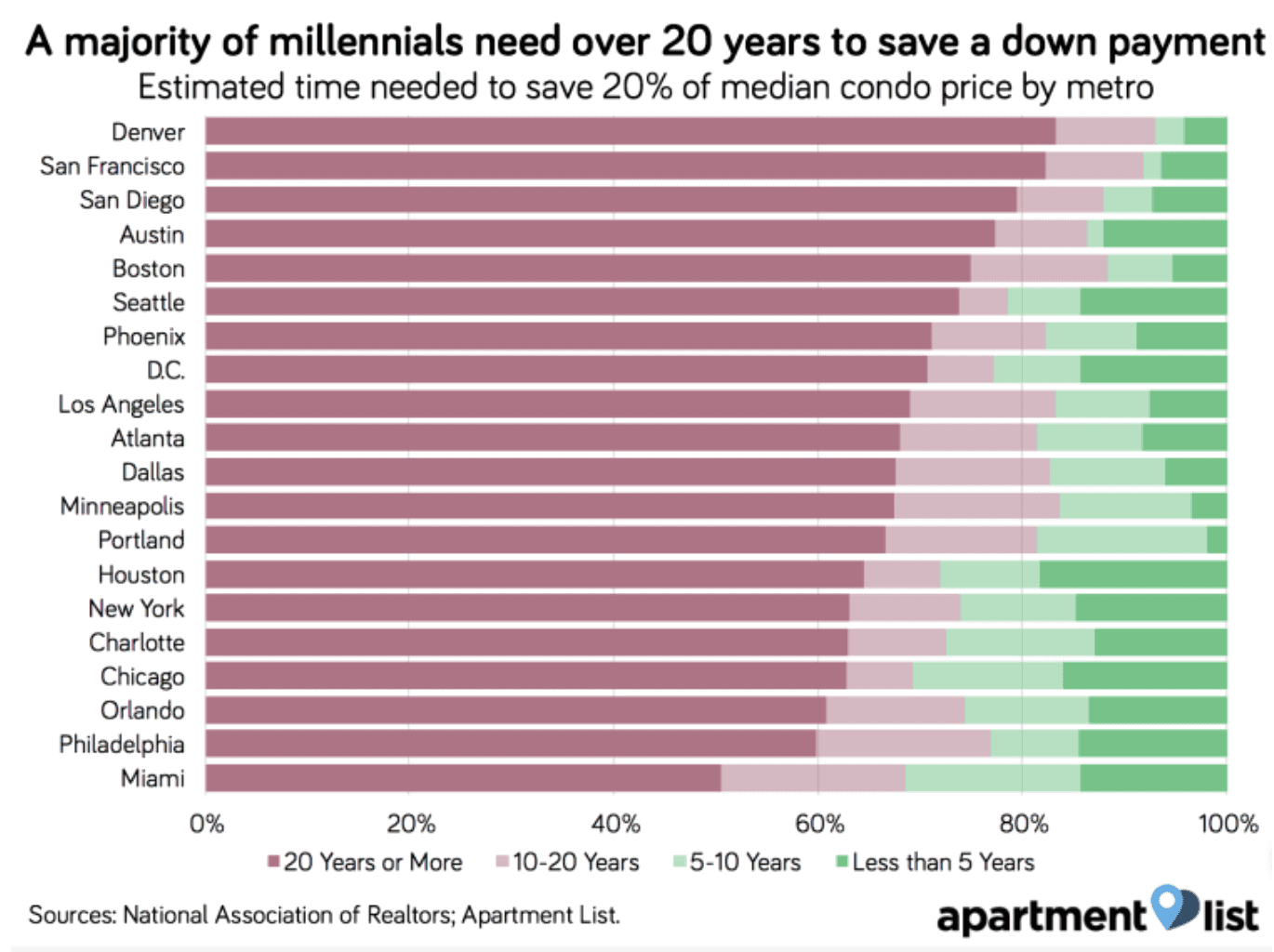

In fact, according to Millennial savings rates – which are pretty close to zero across the board – it would take more than 20 years to save up just a 20 percent down payment. Only 11 percent of them could swing it in the next five years.

Millennial buyers and Denver South real estate

Here in Denver, despite the metro area’s rapid growth in recent years, it’s essentially the same story.

According to Chris Salviati, a researcher at ApartmentList: “9 in 10 Millennial renters want to purchase a home, but just 4.4% plan to do so within the next year. In Denver, over 80% of Millennials will need an estimated 20+ years to save up for a 20% down payment on a median-priced condo.”

According to the ApartmentList study:

- 87% of millennial renters in Denver plan to purchase a home, but only 5 percent expect that to be within the next year

- 28% won’t be able to buy “for at least five years.”

- 47% have $0 saved for a down payment

Combining the fact that Millennials are about to be the largest generation in the U.S., with the largest purchasing power as a result, this trend could be challenging for the local real estate market.

Because every real estate transaction needs a buyer. If Millennials are sitting on the sidelines, waiting to save up for a down payment, the market won’t have the buyers it needs to grow.

And that could impact the price increases we’ve been enjoying across Denver South.