State & Local Taxes

Property Taxes

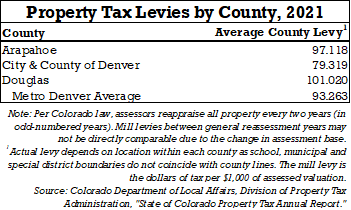

In Colorado, property tax is levied on real and personal property based on its assessed value and the local tax districts providing services to the area.

The mill levy is the tax on each $1,000 of assessed value for the property (actual value x assessment rate / $1,000 x mill levy). The average levy including all tax districts in the Denver South region ranges from 79.013 in the City and County of Denver to 101.199 in Douglas County.

Sales and Use Tax

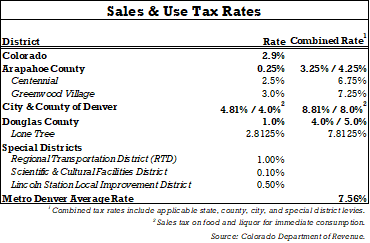

Combined state, local, and special district sales tax rates in the Denver South region range from 3.25 percent in unincorporated areas of Arapahoe County to 8.81 percent in the City and County of Denver.

Many areas in the Denver South region have sales and use tax rates below the Metro Denver average of 7.56 percent.

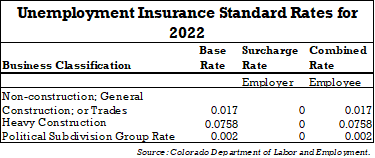

Unemployment Insurance

Colorado’s unemployment insurance rates vary among established employers, depending upon the history of taxes and benefits paid, and the Unemployment Insurance Fund balance.

The majority of new employers (non-construction) are charged a standard tax-based rate depending on the type of business activity. For rate year 2021, the rate consists of only the base rate.

An employer’s unemployment insurance tax liability is based on the taxable wage base, which is the first $13,600 of each worker’s wages.

Workers’ Compensation

Colorado’s rates are among the lowest in the country. Workers’ compensation insurance is provided by more than 200 private insurance companies and the State Compensation Insurance Fund, d.b.a. Pinnacol Assurance, an independent political subdivision of the State, which operates as a workers’ compensation insurance company.