Welcome to the Denver South EDP Guest Blog Series

Denver South Economic Development Partnership’s Greater China Exchange Coordinator, Sean Doherty, weighs in on the battle between the U.S. and China for technology innovation dominance.

While there are certainly differing opinions about what the future will look like, one thing is certain: it’s going to be digital.

The best and brightest from the US, China, and other countries are actively working to digitize the future, work that has already enabled instant communication with anyone at any time, virtually unlimited storage of information in the cloud, and nearly instantaneous deliveries of online shopping orders.

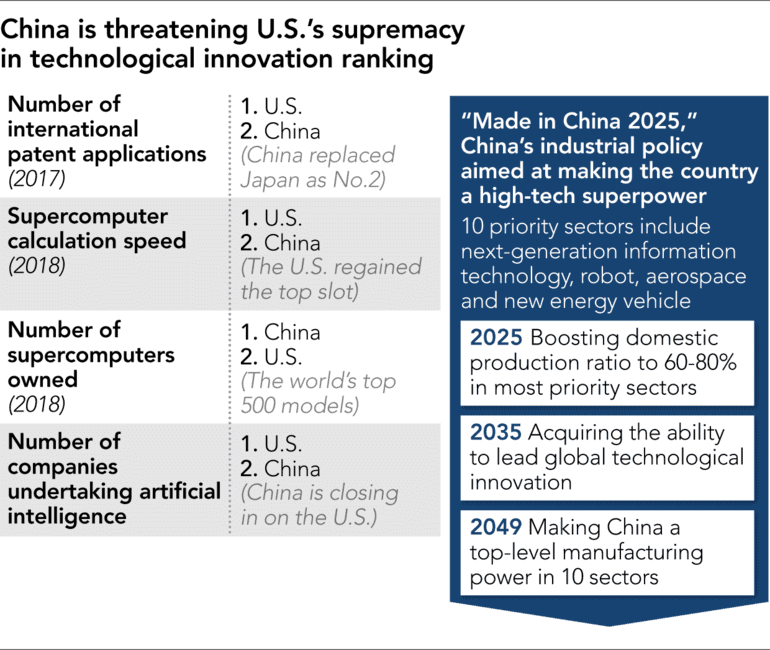

With self-driving cars, artificial intelligence, and quantum computing just around the bend, the 10 trillion-dollar question is: which companies will end up crossing the finish line first? And despite the considerable head start for Silicon Valley firms, their counterparts in China have been gaining ground. The results of Navigant Research’s annual report on companies involved in developing self-driving cars are particularly telling. This year, the Chinese search-engine company, Baidu, “…was rated among ‘contenders’ along with companies such as Toyota, Jaguar Land Rover, and Hyundai Motor, moving past the likes of Tesla, Uber, and Apple.”

But this race goes well beyond the car track and involves more than a few companies in what The Economist, has dubbed “the world’s most titanic commercial fight.” The combatants “…are the towering giants of American and Chinese tech industries, led by FAANG (Facebook, Amazon, Apple, Netflix, and Google) on one side and BAT (Baidu, Alibaba, and Tencent) on the other…some of the planet’s biggest firms, with a combined stock market capitalisation of more than $4 trillion.”

There’s another side to the battle, and what’s at stake is not just billions of Dollars and Yuan.

The battle is quickly evolving into a competition for access to the hearts and minds (or at least the data) of the international citizenry. In concluding the above-mentioned article, The Economist writes, “America and China are vying for digital supremacy. The fight between their tech champions in other markets will inevitably have political overtones…Online data provide the fuel for artificial intelligence; deciding if they flow into Chinese computing clouds or American ones could have consequences for how dependent countries become on one superpower.”

Of course there are concerns and debate over how to deploy artificial intelligence (AI), and the ethics are difficult to elucidate before we actually begin engaging AI as part of life throughout society. But the fact is that AI will be coming soon, whether we are ready or not. The questions brooked by The Economist and others are: who will wield this new computing power and machine capability? Will American companies or Chinese companies reach AI and quantum computing first? And, perhaps of more concern, how much application will there be for the political apparatus of each Superpower? Will AI and quantum computing be a force for Good or Evil? Answering those questions will take time; and though there isn’t a clear path, there are some good indicators of heading in the right direction, or stumbling into roadblocks.

Lately, the path for US tech firms has increasingly become fraught with regulations and lawsuits.

Looking at just Google alone, the search company has been issued a $5 billion fine by EU regulators for “…bundling its search engine and Chrome apps into the operating system” of Android devices. The EU regulators consider this practice to be violating antitrust laws. Who knew that providing free apps on phones could be so expensive! The impact will be felt more broadly across the European continent with the onset of the new General Data Protection Regulation (GDPR) earlier this year. On just the first day of the new policy, Google, Facebook, Instagram and WhatsApp were hit with $9.3 billion in privacy complaints.

Concerns about privacy notwithstanding, when these tech innovators are repeatedly subjected to regulations and must direct time and energy towards legal battles, there will surely be an impact on their core business focus and innovation. All of this regulatory activity—in an industry that is rapidly changing and that may soon outgrow those regulations—has cost the leading firms money, time, and focus, all which might be handicapping their progress towards new frontiers. Just the example of Xerox Corp., which “…assembled a team of 46 people to focus on GDPR compliance,” gives an idea of the resources required to stay within the measures of the new law.

Meanwhile China’s central government has thrown their full support behind their native technology stars.

In China, the government and tech industry form a symbiotic relationship where, as reported by Financial Times, tech firms “…receive preferential regulatory treatment in the form of cheap loans and land from a party-state that relies heavily on them for tax revenues, employment growth, and online surveillance of citizens.” Another key factor propelling the rise of BAT companies is that they “…have benefited from the communist party’s efforts to exclude Silicon Valley’s finest.” The ‘Great Firewall of China’ has acted as a virtual blockade to keep Google and Facebook out, while nurturing Baidu, Alibaba, and Tencent to split the spoils from exclusive access to the world’s largest online market.

Now add to this the important facts that China’s government is investing strategically in their high tech industry–making bets ranging from semiconductors to smart cities—while also providing recruitment incentives for professors in science and technology fields. The result is the perfect formula for a digital transformation across the country. Indeed, these policies have helped China’s tech pioneers to ‘claim’ their status in society as heroes. According to the South China Morning Post (owned by Alibaba), China’s Internet has “become a job creator, an education-enabler, and…a path forward” that is “focused on the needs of people who are hanging onto the bottom rungs of an economic ladder.”

Across the ocean, however, negative opinions and tempers towards tech firms are running high.

“There’s blood in the water in Silicon Valley,” wrote BuzzFeed editor Ben Smith; “The new corporate leviathans that used to be seen as bright new avatars of American innovation are increasingly portrayed as sinister new centers of unaccountable power, a transformation likely to have major consequences for the industry and for American politics.”

Clearly, the major participants in this tech race have very different dynamics. For the front-runners, those original tech innovators (FAANG) of the ‘free market world,’ their increased sensitivity to privacy investigations and new regulations, while weathering a nightmarish PR storm, is the equivalent of hitching a trailer to the back of a DeLorean. Meanwhile, the BAT companies are revving their engines, exchanging Internet censorship for advantages from a government that, while modernizing, still maintains deep roots in communist tradition and ethos.

Suggested Reading:

Differences in media and political systems aside, the digital future will soon be arriving to China and the US, and every other country with an Internet connection. Which companies will hold control of the digital assets, who will deploy artificial intelligence and quantum computing systems first, and how much access the competing Superpowers will secure for themselves remains to be seen.

Sean Doherty is a Colorado native and graduate of Metropolitan State University, living and working in Hong Kong, Shanghai, and Nanjing, China. Sean represents the Denver South Economic Development Partnership as the Greater China Exchange Coordinator, focused on fostering the exchange of ideas, strategies, and talent between China and the metro-Denver area. In 2016, Sean was selected as a Jiangsu Province Youth Friendship Ambassador. You can reach out to Sean directly, right here.

China Services

- Product sourcing (from R&D through production, QC, and shipment)

- Factory audits

- China trip coordination and support

- Consulting on the China market and APAC region